New York, NY – Debt collection agency harassment complaints by U.S. military service members rose sharply last quarter, potentially undermining national security interests, according to an independent analysis of data from the Consumer Financial Protection Bureau (CFPB) by BadCredit.org, a website that informs and educates consumers on the latest credit fraud scams, credit repair news, how to dispute debt collection agency notices, and more.

Last quarter, debt collection agency complaints by service members increased by 24% nationally, and attempts to collect on “debts not owed” surged by 40%.

Debt collection harassment complaints by service members against debt collection agencies ballooned from 1,360 in the fourth quarter of 2023 to 1,833 in the first quarter of 2024. The complaint data was collected and analyzed from the Consumer Financial Protection Bureau for a special report.

The full Military Debt Collection Agency Harassment Report was just released. It includes comments from Federal Trade Commission, Consumer Financial Protection Bureau, and US Dept. of Defense officials.

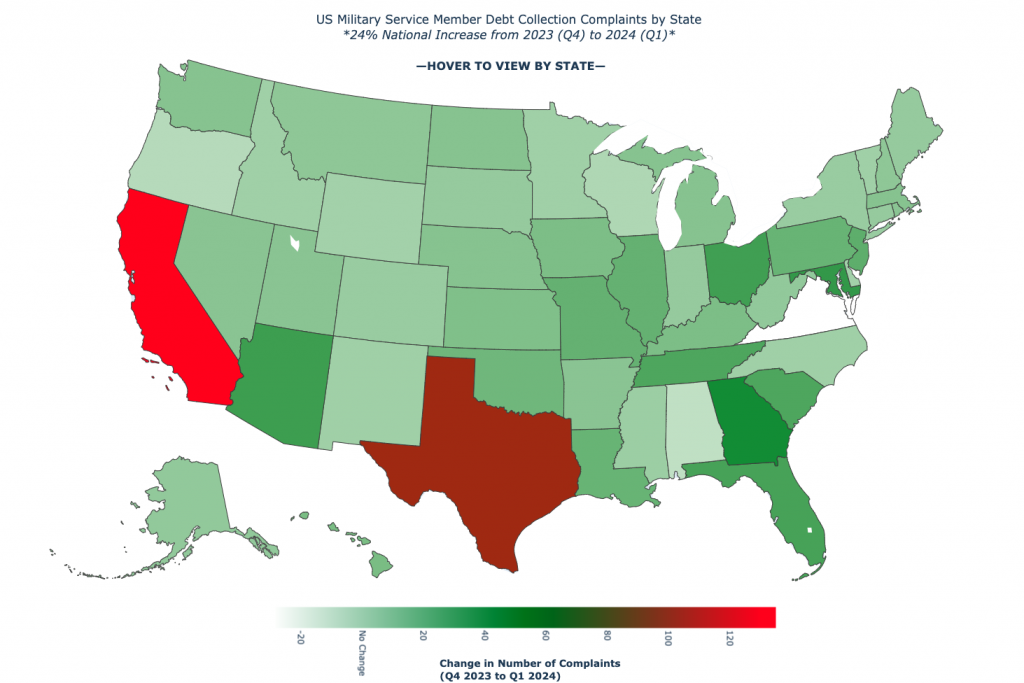

The report features a map that lists by state the total number of Consumer Financial Protection Bureau complaints filed by service members against debt collection agencies for the last quarter of 2023 and the first quarter of 2024, the increase or decrease in complaints by total and percentage, the most reported debt collection agencies, and the top debt collection agency harassment issues reported.

Debt Collection Agency Harassment by State

While the national increase in debt collection agency complaints increased 24%, which is significantly higher than previous quarter-over-quarter periods, these two US states showed the sharpest increases.

Most Reported Debt Collection Agency

Although widely considered a consumer-friendly state, complaints spiked highest in California, which saw a 188% increase in debt collection agency complaints filed from the fourth quarter of 2023 to the first quarter of 2024. California is home to 157,367 military personnel, making it the most populous state for active-duty service members.

Second Most Reported Debt Collection Agency

The second-largest increase in debt collection complaints was in Texas, which saw a 66% jump from the fourth quarter of 2023 to the first quarter of 2024. The U.S. Department of Defense reports 111,005 service members stationed in Texas, making it the third-most populous state for active-duty military.

Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act reportedly harassing military service members most was Resurgent Capital Services, a subsidiary of collection giant Sherman Financial Group. According to Consumer Financial Protection Bureau data, the second worst offender is CL Holdings, the parent company of debt-buyer Jefferson Capital Systems. The third most reported debt collector is publicly traded Portfolio Recovery Associates [NASDAQ: PRAA], which was forced to pay $27 million in penalties for making false representations about debts, initiating lawsuits without proper documentation, and other violations.

To help active duty service members protect themselves against unlawful harassment by debt collection agencies, the names of their credit card subsidiaries are listed in the full report, which may also be useful to US policy and consumer protection agencies.

Military Debt Collection Agency Study Methodology

The data for this study was sourced from the Consumer Financial Protection Bureau (CFPB) complaint database. The dataset specifically targeted complaints filed by U.S. military service members, identified using the tag “Servicemember” within Q4 2023 and Q1 2024. To maintain the quality and reliability of the analysis, certain irrelevant or incomplete records were excluded from the dataset. These included entries lacking essential details, such as the names of credit bureaus in the debt complaint narratives. In debt collections, complaint narratives, references to credit bureau reports, and scores were omitted, since the CFPB maintains a separate category for “Credit reporting, credit repair services, or other personal consumer reports.”

About BadCredit.org

BadCredit.org provides guidance to consumers with bad credit about credit repair, making better credit decisions, and staying on a budget for a brighter financial future. BadCredit.org features blog posts, how-to guides, primary research, studies, and other helpful content split into four different sections: The Bad Credit Blog, Bad Credit Studies and Research, Bad Credit How To Guides, and reviews of credit cards for those with bad credit. Our editorial staff includes savings experts, credit experts, and finance experts, who provide expert commentary on personal finance topics. BadCredit.org supports several financial literacy foundations through charitable contributions to financial literacy nonprofits. BadCredit.org fosters a collaborative work environment for goal-oriented professionals. We offer on-the-job perks such as free lunch catered daily, health insurance benefits including free dental and vision, and 401(k) plans with employer matching.

Source: https://thenewsfront.com/debt-collection-agency-harassment-of-u-s-troops-up-24-quarter-over-quarter/

About BadCredit.org

At BadCredit.org, the web’s top finance experts come together to help inform and educate over 27 million users, enabling better credit decisions and a brighter financial future.